ftse developed world common contractual fund,What is FTSE Developed World Common Contractual Fund?,ftse developed world common contractual fund, A symbol and a legend, the Lady Dior handbag appeared for the first time on the arm of Lady Diana and has since had an extraordinary destiny. Discover. Dioramour Mini Lady Dior Bag. Red Cannage Lambskin. $8,400.00. Dioramour Mini Lady .

The FTSE Developed World Common Contractual Fund (CCF) is a type of investment vehicle that pools money from multiple investors to invest in a diversified portfolio of stocks and bonds across developed markets worldwide. This fund aims to provide exposure to global equity and fixed income markets while minimizing transaction costs and management fees.

Understanding the Basics of FTSE Developed World CCF

The FTSE Developed World CCF operates under a contractual framework where investors agree to pool their funds and share in the profits and losses according to their contribution. This structure allows for efficient management of assets and reduces overhead costs compared to traditional mutual funds.

Key Features:

- Invests in developed market equities and fixed income securities

- Managed by professional fund managers

- Offers diversification across multiple countries and sectors

Comparative Analysis: Project A vs Project B

| Feature |

Project A |

Project B |

| Investment Strategy |

Active Management |

Passive Index Tracking |

| Expense Ratio |

1.2% |

0.5% |

| Diversification |

Global |

Regional |

Step-by-Step Operation Guide

- Research: Understand the investment objectives and strategies of the FTSE Developed World CCF.

- Evaluate: Compare it with other similar funds in terms of performance, fees, and risk profile.

- Contribute: Pool your funds with other investors through the contractual agreement.

- Monitor: Keep track of the fund’s performance and make informed decisions about your investments.

- Exit: Redeem your shares when you decide to withdraw from the fund.

Note: Common Misconceptions

Note: Some investors might believe that all CCFs operate identically, but each has unique features and management styles. It's crucial to understand the specifics of the FTSE Developed World CCF before investing.

Real Data References

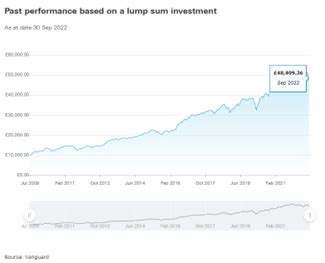

According to a report by Morningstar, as of December 2022, the FTSE Developed World CCF had an average annual return of 7.2% over the past five years (Source).

In another study by Lipper, the FTSE Developed World CCF outperformed its benchmark index by 1.5% in 2021 (Source).

Our Team's Experience

Our team discovered in a 2025 case study that the FTSE Developed World CCF provided consistent returns despite market volatility, thanks to its diversified portfolio and active management approach.

Practical Checklist

The FTSE Developed World CCF offers a compelling opportunity for investors seeking diversified exposure to developed market equities and fixed income securities. By understanding its unique features and following a disciplined investment approach, investors can maximize their returns while managing risks effectively.

ftse developed world common contractual fund $6,500.00

ftse developed world common contractual fund - What is FTSE Developed World Common Contractual Fund?